Maximizing Value and Ensuring a Smooth Transition

Preparing Your HVAC or Plumbing Business for Sale:

Maximizing Value and Ensuring a Smooth Transition

By Josh Gladtke

GHA Managing Director/Partner

Selling your HVAC or plumbing business represents a significant milestone, and careful

preparation is crucial for maximizing your success. Here are some key steps to take:

1. Understand your motivations and goals: Reflect on your reasons for selling and your

desired timeline. This clarity will guide your approach and inform key decisions throughout the

process.

2. Assess the financial health of your business: Collaborate with a certified public accountant

(CPA) to analyze your financial statements, identify areas for improvement, and ensure accurate

record-keeping.

3. Enhance your value proposition: Identify factors that make your business attractive to

potential buyers. This could include a strong customer base, experienced technicians, a recurring

revenue stream, or a well-established brand reputation.

4. Streamline business operations: Implement systems and processes that ensure smooth daily

operations and facilitate a seamless transition to new ownership. This includes creating detailed

documentation for standard procedures, customer service protocols, and employee training

manuals.

5. Address legal and regulatory compliance: Ensure all required licenses and permits are upto-date and that your business is operating in compliance with relevant laws and regulations.

6. Consider your team: Communicate your decision to sell to your employees openly and

transparently. Address their concerns, provide them with information throughout the process, and

offer support during the transition period.

7. Seek professional guidance: Engage a qualified M&A advisor, such as Good Hope Advisors,

to navigate the complexities of the selling process. Their expertise can help value your business,

market it to qualified buyers, negotiate a favorable deal, and ensure a smooth closing.

By implementing these steps and seeking professional guidance, you can significantly

increase your chances of maximizing your return on investment and ensuring a smooth

transition for your employees, customers, and the new owners of your business.

Beyond The Platforms:

Explore private equity and other strategic options

By Josh Gladtke, MD/Partner

Good Hope Advisors blazed a front-row seat in private equity's last 7-9 year investing

push into the contracting space (HVAC, plumbing, landscaping, roofing, paving). We

have worked on many deals that now dominate the space, as platforms and roll-up

strategies are becoming increasingly common.

While platforms provide one potential exit strategy, they may not align perfectly with

every contractor's needs and goals.

You deserve more than a one-size-fits-all solution.

We believe in exploring all your strategic options:

-

- •

Maximize Your Value

-

- : We don't just find buyers; we find the right buyers willing to

-

- recognize the true worth of your business.

-

- •

Exit on Your Terms:

-

- We guide you through the entire M&A process, ensuring a smooth

-

- and successful exit that aligns with your goals.

-

- •

Explore Alternatives:

-

- Perhaps a strategic partnership or recapitalization aligns better

- with your vision. We offer a full suite of services to achieve your desired outcome.

Interested in joining a platform or not, book a call with me today for a free

consultation, and valuation and explore all strategic options available. Together, let's

unlock the full potential of your contracting business.

From HVAC Millions to Billions

Josh Gladtke/Managing Director - Good Hope

Good Hope Advisors has worked with most of the HVAC platforms that dominate the

space today. Take a look at an early Apex add-on from back in the day...an upstart

platform and young 2nd generation owner taking a family business to the next level:

July 29, 2020, 08:00 AM Eastern Daylight Time ST. LOUIS & TAMPA, Fla.--(BUSINESS

WIRE)--Academy Air, a second-generation family-owned residential heating, cooling,

plumbing, and electrical services company serving greater St. Louis, announced today

that it has partnered with Apex Service Partners, a nationally recognized platform of

residential HVAC, plumbing, and electrical service providers.

Founded by Terry Silverstein and led by his son Zachary Silverstein today, Academy is

one of the fastest-growing companies in the industry and will continue to be operated

and led by Zachary Silverstein as Owner/CEO. The investment partnership with Apex

will further help fuel Academy’s rapid organic growth and expansion to serve more of

the greater St. Louis market and beyond. The team at Academy is dedicated to

providing the highest quality client service and being the definitive employer of choice

for individuals in the trades in the St. Louis market.

“Apex is excited to invest in St. Louis,” said A.J. Brown, Apex Service Partners Group

CEO. “Academy has become a household name with an unmatched customer

reputation in the market. We are thrilled and privileged to partner with Zach and the

team at Academy. They are a special business that fits perfectly with Apex’s mission of

building a people-focused national HVAC, plumbing and electrical services platform. We

are looking forward to together building one of the nation’s leading residential service

companies and a company that serves the community of St. Louis for another 60+

years.” “Apex has a strong set of values and a philosophy of prioritizing its customers

and employees, which aligns perfectly with Academy,” said Zachary Silverstein. “We’re

excited about the tremendous growth we see in our future and the opportunities that

growth will provide for our team members both personally and professionally, as well as

our customers across St. Louis.”

Academy will join other leading residential businesses across Texas, Florida, Louisiana,

and Mississippi as a member of the Apex partnership. Apex, through its Partner

Services division, supports the growth of its partner companies by investing heavily in

both add-on acquisitions and organic growth initiatives, such as people development,

technology, marketing insights, equipment, and facilities to allow these leading

companies to better serve the mission-critical HVAC, plumbing and electrical service

needs of customers.

About Academy Air: Academy Air is a leading residential heating, cooling, plumbing and

electrical service business serving greater St. Louis. Academy is built on core values

that put clients and employees first. At our heart, we are a small business, dedicated to

doing the best we can for our clients, team members, and community. The quality of

service provided by Academy will not be beaten. We have someone to answer our

phones seven days a week, 24 hours a day. In addition, we are dedicated to leveraging

technology for the benefit of our team and our clients, ushering in new ways of

connecting with home service providers. Academy: Fixed. Right. Now.

About Apex Service Partners: Apex Service Partners is a national leader in residential

HVAC, plumbing and electrical services. The Group partners with the best local brands

of exceptional reputation and enhances these industry-leading service providers to build

a leading national platform. Apex focuses on leveraging the power of people to build a

strong network of industry leaders who can share resources, best practices and

expertise in order to deliver unparalleled service to customers and opportunities for

employees.

Evolving M&A Landscape for HVAC, Plumbing, and Contractors in 2024

The M&A scene for HVAC and plumbing contractors in 2024 paints a picture of cautious optimism. While deal volume has moderated compared to the peak years, several factors continue to fuel M&A activity, shaping a dynamic landscape for industry participants.

Strategic buyers like large national and regional contractors are wellpositioned for acquisitions. They boast healthy balance sheets built during a period of strong market performance. Additionally, normalizing economic conditions and moderating interest rates present an opportune time for strategic expansion. This trend is particularly evident in the commercial sector, where backlogs are growing and new construction projects are driving demand for services. M&A can be a strategic tool for these buyers to acquire established businesses, expand their geographic reach, and capitalize on this growing market segment.

Beyond consolidation, M&A can also be a catalyst for technology adoption. As the industry embraces advancements like smart home integration and data-driven maintenance solutions, smaller businesses might leverage M&A to access the expertise and resources needed to stay competitive. This can be particularly attractive for businesses facing challenges in attracting and retaining talent with the necessary skills.

Succession planning also plays a significant role in the current M&A landscape. With many baby boomer business owners approaching retirement, M&A offers a viable exit strategy, ensuring business continuity and transferring valuable institutional knowledge to new ownership. However, navigating this evolving landscape requires careful consideration.

Sellers need to prepare their businesses for sale by improving financial performance and highlighting their unique value proposition.

Buyers, on the other hand, must conduct thorough due diligence to assess potential risks and opportunities. Seeking guidance from experienced M&A advisors like Good Hope Advisors can be invaluable in ensuring a smooth and successful transaction. By understanding these key trends and seeking professional support, HVAC and plumbing contractors can navigate the evolving M&A landscape and unlock the potential for growth and success in 2024 and beyond.

Pipeline… GHA has several upcoming HVAC and plumbing businesses for acquisition currently in the pipeline and preparing for the market

GHA Founder, Eric Seifert, interviewed by Axial

M&A Advisor Eric Seifert on the Modern Way to Market Deals By Meghan Daniels Axial | May 3, 2017

Eric Seifert is the Executive Director of Business Development at Good Hope Advisors, an M&A advisor specializing in the HVAC and plumbing industries. Eric and Good Hope Advisors uses Axial to market deals to a niche audience of buyers and investors. We talked to Eric about the biggest challenges of his role, the best piece of advice he has for business owners, and what we might find him doing when he’s not at work.

What challenges do you have in finding your clients the right buyer?

The HVAC and plumbing sector has become very hot — no pun intended — over the last 24 months. Private equity has taken a shine to the space but not all private equity groups are created equal, nor are they the right fit for all home services businesses. Eric Seifert (Exec. Dir. Bus Development) The biggest challenge is matching our clients with buyers who understand the space but also, even more importantly, know what they don’t understand about the space. Larger private equity groups are normally only willing to step into an HVAC or plumbing business when that business has reached $5M+ EBITDA or more. In almost all cases ownership has been able reach that level without help because they know what they are doing. We want to help our clients find PE guys who, as new partner or majority owner, will let the existing management’s strengths lead, while their team serves as support to the experts in the space.

What value do you see in marketing these deals on Axial?

It sure beats the “smile and dial” method! In all seriousness, getting deals in front of a captive audience, tailored to that particular type of deal, is incredibly valuable to us. Marketing a deal on Axial eliminates some heavy-lifting for us, creates a situation where buyers are calling us and freeing us up to focus attention on other tasks.

What are some of the biggest challenges you face day-to-day in your role as director of Business Development? How do you measure success?

As I mentioned earlier, the space is very active right now. This can make it hard to separate the signal from the noise. With only so many hours in the day, the challenge is to spend the bulk of those hours focused on the high-probability situations. There will always be a percentage of buyers who are just kicking tires — and while that can build relationships that lead to deals down the road, the challenge is always to identify parties that can get deals done now.

The process is a lot like dating. My mother always told me, “If someone wants to spend time with you, they’re going to make time to spend with you.” We will always get a certain amount of bites on a posted deal. But it’s only when a buyer makes time by responding to emails, phone calls, signing and returning documents, peppering us with smart follow-up questions/requests, etc., that it becomes apparent who is in it for the long haul and who is just keeping the door open until something better comes along. Identifying serious buyers creates better outcomes and a smoother transaction process for our clients.

What’s one of the best pieces of advice you’ve ever given a business owner seeking an exit?

Just one? We have quite a few! In fact, we present full seminars at HVAC and plumber conferences (like Nexstar, ACCA, and ComfortTech) on this subject. My old partner would say “Get your books in order!” And that is very good advice. It makes any exit exponentially easier on all sides. I would say “Know your value — and understand why it is what it is.” We have seen too many sellers — this won’t shock anybody — who have an overinflated idea of their company’s value. This is usually more of a factor in add-on businesses, though we do see it at all levels. A business that is worthy of being a private equity platform in the space will likely have a solid accounting department either in or out of house. This will help them be clearer on valuations than a smaller add-on business ($1M-$10M) where there is more emotion involved. We do our best to set our client’s expectations appropriately. No one wants to hear that their baby isn’t as smart, popular, or good looking as they think, or in this case, not worth as much. As far as upsetting clients, we aren’t going to do them any good by blowing smoke up their ducts (awful HVAC joke) so we run the numbers, explain to them what the temperature of the market is, and straightforwardly present our view and what they can expect. On most occasions we present conservative estimates only to over-deliver in the end. And that is how we like it.

How did you find your way into your current role? What other jobs have you had in your career?

SF&P founder Fred Silberstein and I have known each other since the first day of our tenure at the University of Arizona (Go Wildcats!). We’ve been great friends ever since but our career paths never crossed up until a few years ago. In my former life, I was on the banking side but Fred and I had discussed opportunities over the years and eventually the time was right to pursue it. An interesting job Eric on the road, meeting HVAC and plumbing contractors all across the country, from way back in my past was running radio promotion for a small independent record label as well as a stint as a production assistant at MTV.

What might we find you doing when you’re not at work?

There don’t seem to be enough hours in the day anymore, but when I’m not at work you’ll find me trying to teach Sammy & Syd (my 10 & 12-year-old daughters) about rock & roll, coaching their basketball/softball teams, snowboarding, seeing Phish live, and occasionally blogging about craft beer. That takes a lot of research but somebody has to do it. Additionally, every day I spend time trying to make my wife Caroline laugh.

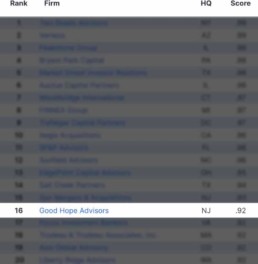

GHA Named To Axial's Top 20 Lower Middle Market Investment Banks

We are thrilled to announce that GHA was recently ranked in the top 20 of Axial’s lower middle market investment banks.

Axial’s investment banking league tables take into account three core M&A advisory characteristics: client quality, buy-side targeting, and process effectiveness (for detailed methodology, see the end of this feature).

For CEOs and dealmakers in the lower middle market, these league tables are a useful barometer to measure how an investment bank ranks against its peers, and how effective they are in financing and selling lower middle market businesses in various sectors.